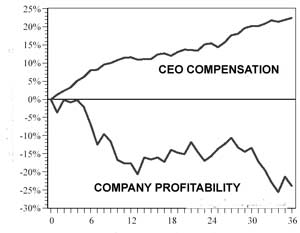

So the major banks have been given billions of dollars from TARP so we could start borrowing money to buy cars and homes to get the economy going again. But now that the banks are awash in cash they’re keeping it in the bank. It seems that the banks are hoarding their cash so they can pay back TARP funds and of course, so they can raise the pay of their CEO’s. After all, they claim if they can’t pay millions to the top help, they won’t be able to hire good managers?

According to Fortune Magazine, writing about the large amounts of cash that lending institutions have on hand:

“The rise was even more dramatic at Bank of America, where cash on hand soared to $173 billion at the end of the first quarter from $33 billion at year-end. CEO Ken Lewis, whose Charlotte-based bank recently acquired the troubled broker-dealer Merrill Lynch, called the shift “very expensive in the short term but well worth the cost in the long term.”

Other institutions holding cash are Goldman, $164 billion, Morgan Stanley $150 billion, AmEX, $25 billion in the third quarter from $13 billion in the forth quarter.

Here’s another quote from Fortune Magazine:

“Liquidity allows the banks to lend if they can find borrowers who can pay them back,” said Gary Townsend, a former bank analyst who now runs Hill-Townsend Capital in Chevy Chase, Md. “That’s the big challenge right now, because the risk-adjusted returns are as big as we’ve seen in a couple of decades.”

Interpret that statement to mean if you want to borrow money from a bank, you must have enough money and assets that you really don’t need to borrow money.